homewise® FY2021 ANNUAL REPORT

Message

from the CEO

Chief Executive Officer

President

Chair, Board of Directors

Over this past year, Homewise has remained flexible and adaptable as we continue to focus on achieving our mission in an impactful and organizationally sustainable way in this ever-changing environment. What began as a quick pivot to delivering our programs and services remotely, evolved into the need to respond to changing economic and market conditions with innovative new programs, services and assistance for our clients.

For many families in New Mexico, the economic hardships caused by COVID-19 affected their ability to pay their mortgage on time and keep their home asset that they worked so hard to achieve. Losing your home to foreclosure is a traumatic process that can, in worst-case scenario, increase the number of homeless people in our community, create negative impact on neighborhoods, and put a further strain on limited social services. We believe that the best approach to this crisis is a proactive approach, so we launched the Emergency Mortgage Assistance Fund. This year, Homewise raised over $700,000 and helped 290 families across New Mexico continue to make their mortgage payments and stay in their homes during this time of financial hardship.

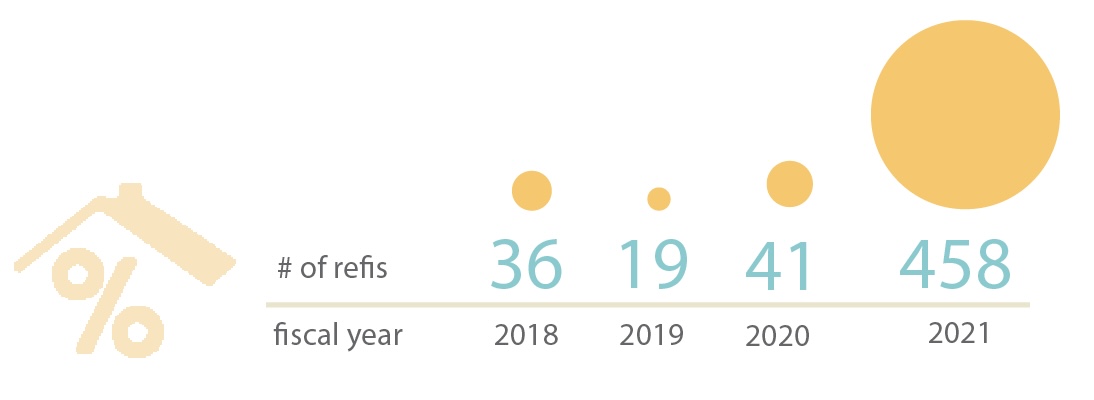

With mortgage rates at historic lows, and many families looking for ways to save money, we saw an opportunity to help many of our clients refinance their current mortgage to reduce their monthly payment. We quickly dedicated more staff and increased our outreach efforts to meet the demand and provide our clients with the highest level of service, even in a remote-working environment. This year, Homewise helped over 450 clients refinance their mortgage, a 275% increase over the prior year.

We also heard from several clients that they were looking for ways to reduce the overall cost of maintaining their homes and wanted to know more about options like energy-efficient home improvements, low water usage landscaping, and do-it-yourself projects. In response, we launched our newest education offering, an online course called New Home, Now What?, which covers topics ranging from basic home maintenance and repair, to low cost home security options, to creating a home savings plan, and more. Over 100 people have already attended the class and are now more empowered to be long-term successful homeowners.

This year, with the support of the New Mexico Small Business Investment Corporation, we also launched our first ever commercial loan initiative to help small business owners, particularly those operating in disinvested neighborhoods, to purchase their own building for their business. Homewise launched this program to help existing businesses own their own facilities, thereby helping them build wealth and increase stability. The program also aims to help decrease vacancy in disinvested communities by enabling the purchase of vacant commercial buildings. Later in the report is a video featuring our very first commercial loan client, Por Vida Tattoo, which we hope you will enjoy.

Another major milestone achieved this year was the launch of the Community Catalyst Fund with our partners at Anchorum St. Vincent and Enterprise Bank & Trust. The Fund is a capital source to finance high impact and much-needed community development initiatives across New Mexico like creating affordable housing and mixed-use developments, helping homeowners make energy-efficient home improvements, creating low-impact rental housing through casitas and guest houses, and helping seniors make necessary home modifications to age in place. Since we originally launched the Fund, the Santa Fe Community Foundation, Illinois No 3 Foundation, New Mexico Bank & Trust, and two individual investors have also made investments, bringing total investments in the Fund to over $16.5 million.

And last but certainly not least, we’re excited to share a change in the structure of our executive leadership team. Mike Loftin has served as the CEO of Homewise for 29 years, and continues to drive the long-term vision, strategy, and financial wellbeing of the organization. We’ve also now added the role of President to our executive team, which will be filled by Laura Altomare. Laura has been with Homewise since 2014 and previously served as our Chief Communications Officer. She also recently served as our Acting CEO while Mike was on sabbatical. In this new role, Laura will lead the Senior Leadership team to set and implement organizational strategy and direction while ensuring the organization is achieving its mission in a highly impactful and organizationally sustainable way. With Laura in this role, Mike now has the opportunity to shift his focus more heavily toward advancement of our HomeWisdom thought leadership initiative to increase national awareness among policy makers, community organizations, and philanthropy that affordable homeownership strategies are effective in improving the financial security of low-income households and in strengthening neighborhoods.

It’s been a year of adaptability and flexibility for all of us and we invite you to read more about our work, and meet some of the people who have experienced its transformative impact, in the pages of this year’s annual report. We remain deeply committed to serving individuals, families and communities across New Mexico and continuing to deliver on the promise of our mission. Thank you for supporting Homewise.

Homewise

by the Numbers

Homewise has been helping New Mexicans become successful homeowners for 35 years. 2020 was no exception. During the past 18 months, we were able to safely and effectively carry out our mission by serving our clients in new ways and collaborating with key community partners to provide relief and resources for those affected by COVID.

Our core pillars of education, sustainable homeownership, neighborhood vitality, and community engagement inspire real solutions and create a clear path toward creating financial wellbeing and building stronger communities.

who are building wealth and improving their financial wellbeing.

that will allow homeowners to improve their homes and increase savings.

to increase the options for high quality affordable housing in Santa Fe

who were able to make their mortgage payment despite financial hardship caused by the COVID-19 pandemic.

who are better informed about their finances and the path to successful homeownership.

REAL ESTATE

15 disinvested properties

that Homewise acquired, renovated, and sold to individuals and families with low-to-moderate incomes

362 clients

worked with a Homewise Realtor and found the right home for their budget and lifestyle

37 homes

were listed and sold by Homewise Realtors on behalf of the sellers, 18 of which were sold to Homewise clients who became new homeownersCOACHING & EDUCATION

3 new online classes

covering Financial Fitness, Homebuyer Education and New Homeowner basics in English and Spanish

13,441 hours

of free 1-on-1 personal financial coaching in English and Spanish

848 clients

became financially ready to buy a home and were prepared to be successful homeowners

LENDING

$578M in mortgage loans

that we process and service

$2.5M in down payment assistance funds

were dispersed to 132 individuals/families to help overcome financial barriers to homeownership

98.2% of our clients

continued to make their mortgage payments on time despite financial hardship caused by the pandemic (as of 3/31/21)

| by household | |

230 |

unrelated & single adults |

122 |

married with children |

60 |

single parent |

45 |

married with no children |

| by age group | |

36 |

18-24 years |

245 |

25-34 years |

225 |

35-44 years |

172 |

45+ years |

| by employer | |

75 |

healthcare |

74 |

local business |

74 |

city, state & federal govt |

69 |

national business |

67 |

construction |

62 |

education |

45 |

nonprofit |

38 |

hospitality |

35 |

self-employed |

14 |

finance |

94 points

average increase in credit score

for clients who started with a score under 640*$7,000

median increase in savings

for clients who started with less than $5,000 savings*$211

monthly decrease in debt

for clients who started with 10% or more debt ratio**clients who successfully completed the steps in their financial action plan

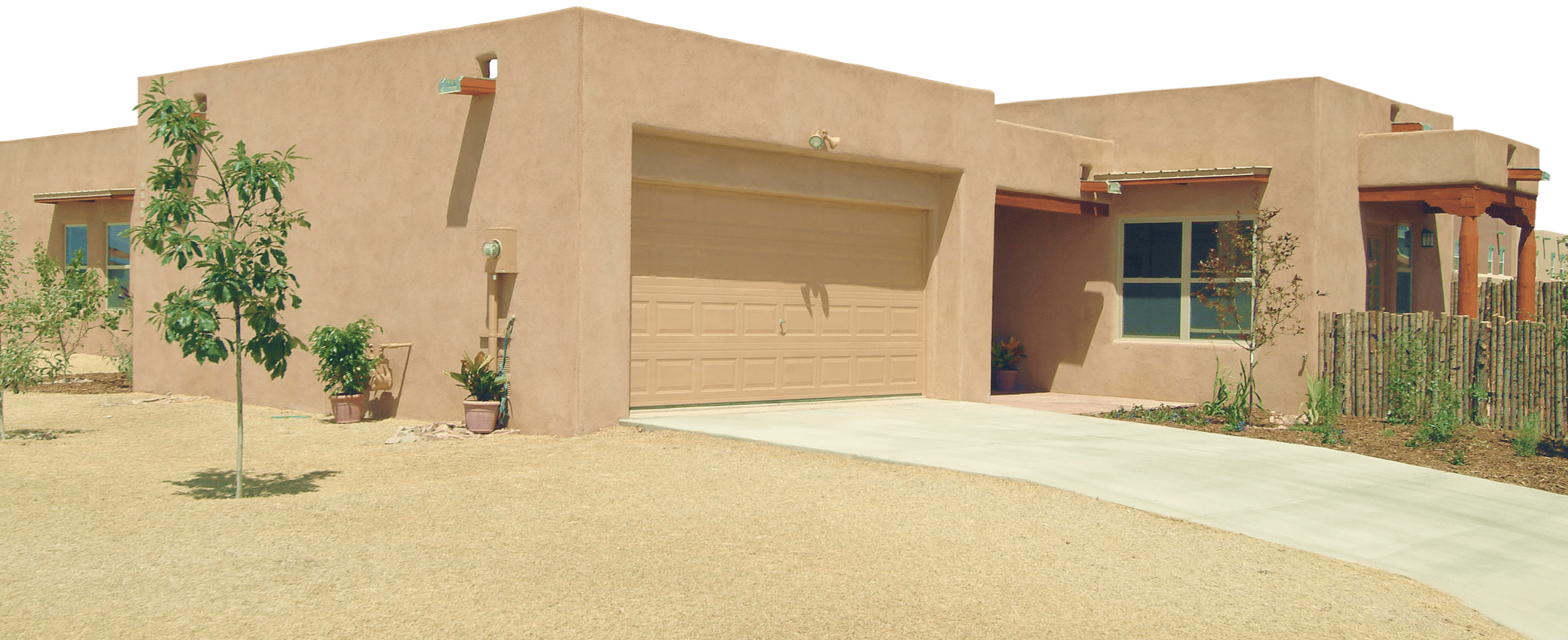

If you build it...

An affordable community at Vista Serena

This year we built and sold all of the homes in our newest community in record time. Vista Serena is a community of 50 single family homes tucked along the scenic western edge of Tierra Contenta with mountain views. This community has access to 324 acres of open space, parks, and trails. Vista Serena is adjacent to SWAN recreational park and is just minutes from Southside Public Library.

Vista Serena helped address the ongoing need for affordable housing in Santa Fe. This community offered both market rate homes starting at $275,000 and affordable homes for families and individuals who earn less than the area median income.

Vista Serena showed signs of great success from the beginning. Before building and the onset of the pandemic, Homewise held a launch party to familiarize the community with the project. Before the model home was even completed, the Homewise sales team had sold 28% of the homes available in this new community, which would later go on to sell out within the year.

A place to finally

put down roots

Jesus wanted to buy a home, but in a tight real estate market, he wondered if owning a home was possible. He called Homewise and was able to find a home in his price range through a program in which we purchase and rehabilitate vacant homes in need of repair, and then sell them to new homeowners in the community.

Responding

to COVID

– from a single mother with 3 children

Prior to the pandemic, Homewise offered all of our financial and homebuyer education classes in person at our Santa Fe and Albuquerque locations. The COVID-19 pandemic prevented in-person gatherings and required us to pivot in our methods to provide valuable education and satisfy demand for these popular classes.

We decided to provide this content in a video format on YouTube and used an online survey form to conduct learning assessments. This satisfied our primary goal: to continue offering the education about homeownership and financial fitness at the same, high quality. Offering the courses on common platforms that most students can access from their smartphones also made the course more flexible, now possible to complete in shorter chunks on their own schedule – as opposed to in person classes offered only at a specific date and time. Not only did this method overcome the challenges presented by remote learning, these efforts actually increased enrollment for Homewise classes!

Erin's Story:

an artist’s journey to finding an affordable home

“I came to Homewise in 2016 and was one year into being a self-employed business owner. I had just moved back to Albuquerque because I could not afford Santa Fe anymore. My sister had just bought a house through Homewise, and we were going to help each other make a go of it.

I have always been an artist. When I graduated from college, I knew that I could not make a living as an artist so I went through a bunch of different jobs working in galleries, museums, and entry-level teaching jobs. I knew I had to get a Masters degree if I wanted to do anything more in that world. I succeeded in receiving the education I wanted but, unfortunately, shortly thereafter, the economy tanked. I felt lucky to get a job for half the salary I originally expected to receive, but even those were scarce. I had to ask myself ‘What do I want to do?’ I love artists. I want to be around artists. I want to support them, so I started my business as an experiment, and now I’m four years in and it seems like it’s working!

There was a period of time where I didn’t know if I could do the work that I wanted to do and own a home. There was a moment where we tried to see if I could get financed, and the numbers weren’t adding up. But something happened, something very magical. A friend of mine wanted to sell me her house at a moment where suddenly everything came into play. I was eligible for not one, but three down payment assistance programs, and I could not have done this without that help. The grant money I received changed my life. I kept tearing up every time I signed a form and talked about it. I have felt questioned my whole life for the choices I’ve made, for the debt I’ve accrued, for wanting to be around artists and wanting to be an artist. Homewise believed in me and trusted me, and it means I get to keep doing the work that I want to do while enjoying the stability of the home that I own.”

Working Together

to accomplish More

In 2020, Homewise partnered with Anchorum St. Vincent and Enterprise Bank & Trust, two like-minded, local organizations, to create the Community Catalyst Fund.

Our goal is to enhance the quality of life for underserved neighborhoods in Santa Fe, Albuquerque, and other northern and central New Mexico communities through the creation of affordable housing options, mixed-use developments, and new commercial and community spaces.

Anchorum St. Vincent and Enterprise Bank & Trust contributed five million each to the Fund, the largest investment either partner has ever made to a single community-based program. With these funds, we can:

The Community Catalyst Fund enables us to make a much larger impact on easing the city’s chronic affordable housing issue. The Fund will help finance mixed-use developments, as well as the acquisition and rehabilitation of disinvested properties.

We can serve more New Mexicans with a greater variety of needs including home improvement lending, low-impact rental housing through casitas and guest houses, home modifications to help seniors age in place, creating new commercial and public spaces in underserved neighborhoods, and other initiatives that benefit entire communities while proactively creating a healthier and more equitable future.

Projects supported by the Community Catalyst Fund partnership:

An all-solar, mixed-use community located in the heart of Santa Fe with easy access to walking and biking trails.

- 40 single family homes, 30% sold as affordable homes

- 33 condo and live/work spaces, 30% to be sold as affordable homes

- Commercial space for local, neighborhood-friendly businesses such as restaurants, coffee shops and boutique retail

Located in Albuquerque’s bustling Downtown district, an area known for its vibrant arts and culture scene, the Palladium townhomes will have a contemporary design to complement the surrounding architecture.

-

16 townhomes split between two addresses located a block apart

-

Will provide mixed-income housing with help from a New Market tax credit

-

Project also has the support of the City of Albuquerque’s Metropolitan Redevelopment Agency

Tattoo shop thriving in their new

15,000sqft 'PLAYGROUND'

Por Vida is a well-established tattoo studio with deep connections in the Albuquerque community. When the opportunity arose to buy a huge, defunct appliance store in Barelas, Por Vida owner, Bale, saw a chance to expand his business and create a venue to support the surrounding community.

Our

Supporters

We’ve had an amazing year thanks to our generous supporters

Financial Institutions

Ally Bank

Bank of Albuquerque

Bank of America

Bank of the West

BBVA

Century Bank

Enterprise Bank & Trust

Fidelity Bank

First National 1870

Kirtland Federal Credit Union

New Mexico Bank & Trust

Self-Help Credit Union

Southwest Capital Bank

Texas Capital Bank

UBS Bank

United Business Bank

U.S. Bank

WaFd Bank

Wells Fargo

Foundations

Albuquerque Community Foundation

Anchorum St. Vincent

Calvert Impact Capital

Frost Foundation

Illinois No 3 Foundation

Kalliopeia Foundation

The Kuhn Foundation

Los Alamos National Laboratory Foundation

McCune Charitable Foundation

Jessie Smith Noyes Foundation

Onota Foundation

Erich and Hannah Sachs Foundation

Santa Fe Community Foundation

Wells Fargo Housing Foundation

Community Businesses, Government Agencies and Nonprofits

Barelas Community Coalition

CHRISTUS Health

CHRISTUS St. Vincent Regional Medical Center

City of Albuquerque

City of Santa Fe

CDFI Fund, US Treasury

Engage Albuquerque

Housing Partnership Network

HUB International & Central Insurance

National Association for Latino Community Asset Builders

NeighborWorks America

NeighborWorks Capital

New Mexico Mortgage Finance Authority

New Mexico Small Business Investment Corporation

Opportunity Finance Network

PNM Resources

Prosperity Now

Prosperity Works

Sandia National Laboratories

U.S. Economic Development Administration

Religious Institutions

The Domestic and Foreign Missionary Society of the Protestant Episcopal Church

Mercy Investment Services

Religious Communities Impact Fund

Seton Enablement Fund

Sisters of Charity of the Incarnate Word

Individuals & Investment Funds

Ann Alexander and Richard Khanlian

Anonymous

Avalon Trust

Avalon Trust clients

Joel Frederick Barber

Anne Beckett

Beth Beloff and Marc Geller

Erika and Glenn Campos

Lawrence Carreon

Jill and Paul Cook

Quarrier and Phillip Cook

Susan and Conrad De Jong Fund

Lori and David Delgado

Anne Messbarger-Eguia

Cliff Feigenbaum

Kristina Flannigan

Fresh Pond Capital clients

Gwen Gilligan

Elena Gonzales

Edward Grasskamp

John Guffey

Naomi and Robb Hirsch

Michael Kelly

Sally Kuhn

Teresa Leger de Fernandez

Nahum Ward-Lev

Ann Lockhart

Viola Lujan

Susan Matteucci and Michael Loftin

Genevieve and A. Paul Mitchell

Felicia and Daniel Morrow

Julie Moss

Mariel Nanasi and Jeffrey Haas

Kay Naranjo

Agnes Noonan

Laura M. Orchard

Karen E. Orso

Cynthia Piatt

Lynne and Joseph Ptacek

Valeri Purcell

Stacy S. Quinn

Celia D. Rumsey Charitable Trust

Miriam Sagan

Lidia Carbonera-Sanchez and Daniel Slavin

Dr. Shelle Sanchez

Gail Saunders

Tom Saunders

Wilson Scanlan

Jenna Scanlon

Elizabeth and Richard Schnieders

Nan Schwanfelder

Martha and Patterson Simons

Linda and Andrew Spingler

The Sustainability Group clients

Alexis Tappan

Trillium Asset Management clients

Kathy Ulibarri

Mary and Mark Vanderlinden

Paul Vogel

Debra A. Walsh

Paul Zelizer

High Impact

Investing

As we carefully emerge from a difficult and destabilizing year, it’s evident that community resiliency is more important than ever. Cities and communities across the country have used this challenging time for self-examination and envisioning positive change. What about our cities serve us well? What doesn’t? How can we re-open and re-build to promote greater equity and improve quality of life?

With this ethos of creativity and optimism, Homewise has joined with Anchorum St. Vincent and Enterprise Bank & Trust to create a new vehicle for building vibrant, healthy communities in central and northern New Mexico—the Community Catalyst Fund. We invite you to participate in this exciting effort by making an investment in the Fund.

This investment advances high impact and much-needed community development initiatives in Santa Fe, Albuquerque, and other communities in northern and central New Mexico by financing affordable housing and mixed-use developments, creating new homeowners, helping homeowners make home improvements, creating low-impact rental housing through casitas and guest houses, and helping seniors make necessary home modifications to age in place. Community Catalyst Fund initiatives are intended to benefit the entire community by catalyzing development projects and creating new financial products and tools to make these development projects affordable and accessible, positioning New Mexico communities to make a meaningful and lasting impact on affordable housing while helping to create a healthier and more equitable future.