Voting and Alternate Currency

-

Homewise

Homewise

We just had an election this week and while everyone was watching the races that interested them most, we here at Homewise had our eye on a different result: voter turn-out. With turnout exceeding the last midterms, the numbers didn’t disappoint.

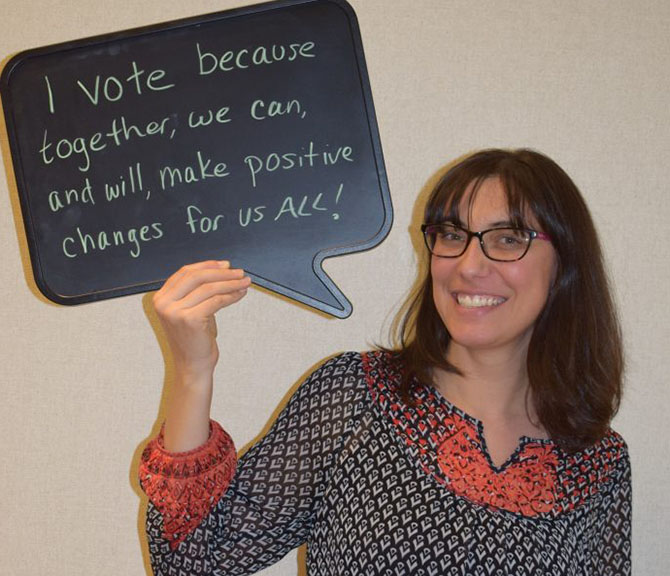

We love voting almost as much as we love homeownership! In fact, several of our Homewise team members have completed the training required to help people register to vote. We had a voter registration party before the registration deadline and all throughout the year we help people get registered. We explain the registration requirements, make copies of required documents, help people update their registration when they move into their new homes and we can even deliver the registration application.

Why do we do this? The answer to that question is embedded in our mission statement: “The Homewise mission is to create successful homeowners so that they improve their financial well-being and contribute to the vitality of our communities.” Community vitality is our end goal and homeowners invest directly in their neighborhoods. But we know there is more than one way to invest in your community. Your time, your energy, and your voice are all a form of investment, a kind of alternate currency (one that is much easier to grasp than Bitcoin).

Voting is an invaluable currency. It engages people, inviting them to pay attention to the decisions that are being made in their names. And we’re not just talking about the high profile national elections. Votes for city council, county commission, school board and the like all have a direct impact on our communities. Just showing up at the polls forces decision makers to take you seriously, to think about you and your community when they act. And while we hear a lot about the role of money in politics, all that money is really just chasing one thing: your vote. If you’re not registered, who’s chasing you?

The vote isn’t the only kind of alternate currency we think about at Homewise. We see first-hand how people invest their time and their energy into their futures during their home purchase journey. Take the downpayment for example. Most lenders look at it only in terms of dollars and risk. They see a downpayment of two percent and say “Too risky. Not enough skin in the game.” At Homewise, we don’t see two percent. We see two years of saving, paying off debt, and building credit. We see two years of watching where each nickel and dime goes, and diverting money from the “dinner out” fund to the “downpayment fund.” That kind of investment is hard to measure, but it is surely invaluable and it most definitely constitutes skin in the game.

It’s intimidating to hear big dollar figures thrown around, whether we’re talking about campaign fundraising or median home prices, but we hope everyone will remember they have other currencies to invest. If you voted in this last election, give yourself a high five. And if you aren’t registered yet, come by our office and we’ll help you get in the game!